A Lease That Can Continue Indefinitely as Long as the Property is Producing a Profit

Finance Lease or Operating Lease? What is the Difference? 2020 Update

Updated: April 2020

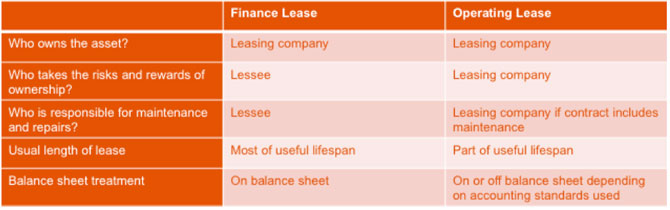

The world of asset finance and leasing isn't always as clear as it could be. And one of the frequent areas of confusion we come across is understanding the difference between a finance lease and an operating lease. Let's try to explain…

Generally accepted accounting practice (both SSAP 21 and IAS 17) defines an operating lease as 'a lease other than a finance lease'. So we need to start with understanding what a finance lease is.

Prefer to watch? Here's a short video overview:

What is a finance lease?

A finance lease is a way of providing finance – effectively a leasing company (the lessor or owner) buys the asset for the user (usually called the hirer or lessee) and rents it to them for an agreed period.

A finance lease is defined in Statement of Standard Accounting Practice 21 as a lease that transfers

"substantially all of the risks and rewards of ownership of the asset to the lessee".

Basically this means that the lessee is in a broadly similar position as if they had bought the asset.

The lessor charges a rent as their reward for hiring the asset to the lessee. The lessor retains ownership of the asset but the lessee gets exclusive use of the asset (providing it observes the terms of the lease).

The lessee will make rental payments that cover the original cost of the asset, during the initial, or primary, period of the lease. There is an obligation to pay all of these rentals, sometimes including a balloon payment at the end of the contract. Once these have all been paid, the lessor will have recovered its investment in the asset.

The customer is committed to paying these rentals over this period and, technically, a finance lease is defined as non-cancellable although it may be possible to terminate early.

At the end of the lease

What happens at the end of the primary finance lease period will vary and depends on the actual agreement but the following are possible options:

– the lessee sells the asset to a third party, acting on behalf of the lessor

– the asset is returned to the lessor to be sold

– the customer enters into a secondary lease period

When the asset is sold, the customer may be given a rebate of rentals which equates to the majority of the sale proceeds (less the costs of disposal) as agreed in the lease contract.

If the asset is retained, the lease enters the secondary period. This may continue indefinitely and will come to an end when the lessor and lessee agree, or when the asset is sold.

The secondary rental may be much lower than the primary rental (a 'peppercorn' rental) or the lease may continue on a month by month basis at the same rental.

A finance lease example

Finance lease is commonly used for financing vehicles, particularly hard working commercial vehicles, where the company wants the benefits of leasing but does not want the responsibility of returning the vehicle to the lessor in a good condition.

Beyond commercial vehicles, finance lease can be used for many other assets, here's one example:

A health club was looking to invest in new gym equipment. The total amount financed was £20k with the agreement set to 60 monthly payments with no deposit. Crucially the balloon payment was set to £0, meaning the client (or more likely their gym users!) is free to really sweat the equipment knowing that there is no liability at the conclusion of the agreement. The option after 60 months will be to sell the equipment – retaining funds made, or to enter a peppercorn (secondary) rental period for a relatively small amount.

Operating lease

In contrast to a finance lease, an operating lease does not transfer substantially all of the risks and rewards of ownership to the lessee. It will generally run for less than the full economic life of the asset and the lessor would expect the asset to have a resale value at the end of the lease period – known as the residual value.

This residual value is forecast at the start of the lease and the lessor takes the risk that the asset will achieve this residual value or not when the contract comes to an end.

An operating lease is more typically found where the assets do have a residual value such as aircraft, vehicles and construction plant and machinery. The customer gets the use of the asset over the agreed contract period in return for rental payments. These payments do not cover the full cost of the asset as is the case in a finance lease.

Operating leases sometimes include other services built into the agreement, e.g. a vehicle maintenance agreement.

Ownership of the asset remains with the lessor and the asset will either be returned at the end of the lease, when the leasing company will either re-hire in another contract or sell it to release the residual value. Or the lessee can continue to rent the asset at a fair market rent which would be agreed at the time.

Accounting regulations are under review, however at the current time, operating leases are an off balance sheet arrangement and finance leases are on balance sheet. For those accounting under International Accounting Standards, IFRS16 will now bring operating lease on balance sheet – read more about IFRS16 here.

A common form of operating lease in the vehicle sector is contract hire. This is the most popular method of funding company vehicles and has been growing steadily.

Why choose one type of lease over the other?

This is a complex question, and each asset investment should be considered individually to ascertain which type of funding is going to be most advantageous to the organisation. There are, however, two key considerations; the type and lifespan of the asset and how the leased asset will be reflected in the organisation's accounts.

Type and lifespan of the asset

As mentioned above, the key thing to remember is that under an operating lease the risks and rewards of owning the asset remain with the lessor, under a finance lease these are largely transferred to the lessee.

In very general terms, if the asset has a relatively short useful lifespan within the business, before it will need to be replaced or upgraded, an operating lease might be the more commonly selected option. This is because the asset is likely to retain a significant proportion of its value at the end of the agreement and will therefore attract lower rentals during the lease period. As the lessor is taking the risk in terms of the residual value of the asset, this will be priced into the overall cost of the contract.

For assets where it is possible to influence the condition at the point of return to the lessor, and therefore give greater certainty to residual value estimates, this 'cost of risk' can be significantly reduced. Asset types where this is the case include cars, commercial vehicles and IT equipment.

If the asset is likely to have a longer useful life within the business, then considerations of its residual value become less critical, as this is likely to be a much smaller proportion of its original value. This may mean that the lessee is happy to take this risk in-house rather than paying a charge to the lessor for it. Here, finance lease is a more obvious choice.

As the rentals paid under a finance lease pay off all, or most, of the capital, it's often possible to arrange a secondary rental period, and retain use of the asset, at a much reduced cost.

Accounting treatment of finance and operating leases

The treatment of the two different lease types depends on which accounting standards the organisation adheres to.

For organisations that report to International Financial Reporting Standards (IFRS), the introduction of IFRS16 from 1st January 2019 means that both operating leases and finance leases must be reflected in the company balance sheet and profit and loss account. Prior to this, operating leases were treated as 'off-balance sheet' items.

Most small and medium-sized enterprises currently report to the UK's generally accepted accounting principles (UK GAAP). The change to the treatment of leases will only filter through to companies applying UK GAAP if they convert to IFRS/FRS 101 Reduced Disclosure Framework, rather than FRS 102. The expectation from the FRC is that the earliest UK adoption could be 2022/23, but it will be monitoring and watching the international impact until then.

For businesses that do now have to reflect operating leases in their accounts, the impact is as follows:

- Balance Sheets – lessees will need to show their 'right to use' the asset as an asset and their obligation to make lease payments as a liability.

- P&L accounts – lessees will show depreciation of the asset as well as interest on the lease liability. The depreciation would usually be on a straight-line basis.

For businesses that are not affected by these changes, the ability to fund assets while keeping them off-balance sheet can be the deciding factor in selecting between operating and finance leases.

> You can read answers to other asset finance FAQs here

Annual Investment Allowances

Many organisations seek to maximise the corporation tax benefits of utilising their Annual Investment Allowances (AIA) when acquiring new assets. These allowances provide organisations with instant tax relief on 100% of the cost of a newly acquired asset. Since 1st January 2019 the allowance has increased to £1m per annum.

However, to qualify for this relief the assets must be 'purchased' and not 'leased'. This means that assets financed through both operational and finance leases are not eligible for AIAs, but assets acquired using funding methods such as contract purchase and hire purchase are.

To find out more about Annual Investment Allowances click here.

Summary

The classification of a lease as either a finance lease or an operating lease is based on if the risks and rewards of ownership pass to the lessee. This can be subjective and it is important that the leasing contract is carefully reviewed.

So, it turns out that giving a simple explanation isn't that simple! If there's anything you think needs clarifying further or you have any questions, please add in the comments below.

You may also be interested in:

>> Coronavirus Finance Options

>> Tax Implications of Business Car Leasing

boddenthrepar1955.blogspot.com

Source: https://maxxia.co.uk/blog/finance-lease-vs-operating-lease/

0 Response to "A Lease That Can Continue Indefinitely as Long as the Property is Producing a Profit"

Post a Comment